Once again, the estuaries along the Atlantic seaboard saw good to very good glass eel runs. Quotas per fisherman were often reached quickly (see following news).

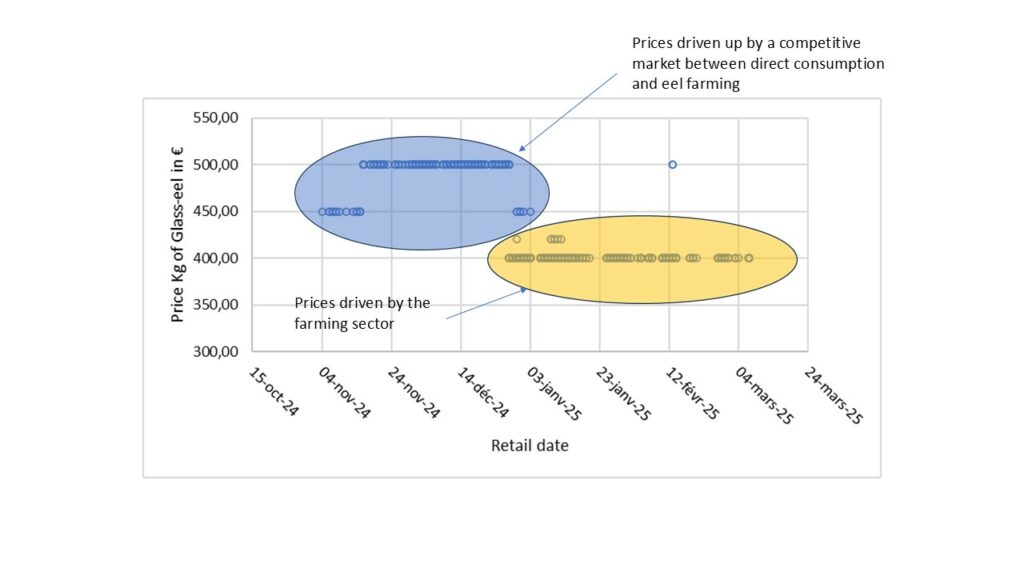

At the start of the season, the price allocated to glass eels caught on the consumption quota (40% of the total quota) was driven up by demand from the Spanish market for the end-of-year festivities (direct consumption), as shown in the graph below.

After the end-of-year festivities, the market is less competitive and demand from the farming sector conditions the price, which is revised downwards by around a hundred euros.

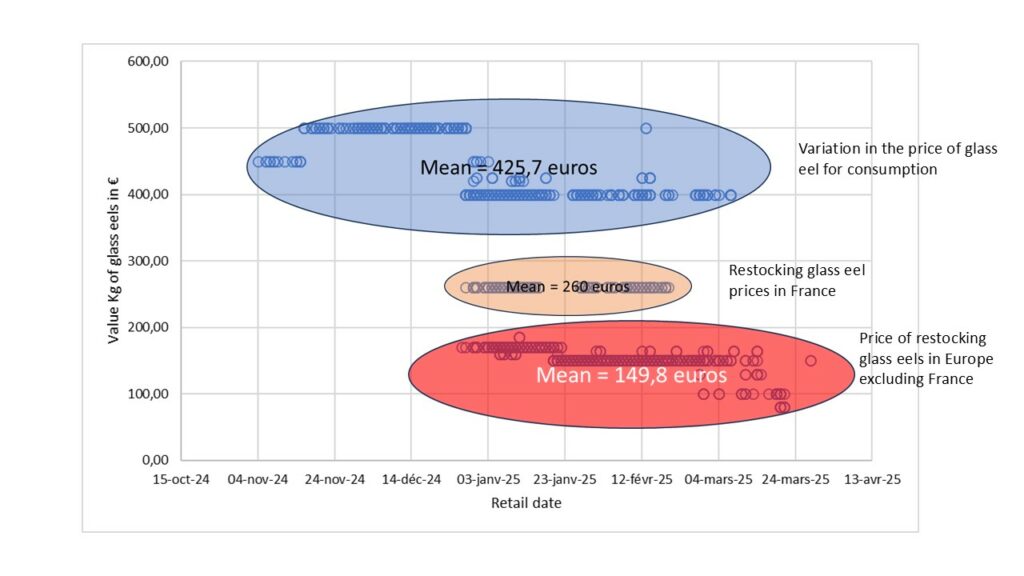

While glass eels for consumption enable fishing industry to sell their catches at a good price, the same cannot be said of glass eels for restocking, which account for the largest part of the quota allocated (60% of the total quota) to French fishing industry (the only producer in Europe for the restocking market).

The growing stranglehold of the farming sector on the market for restocking glass eels has led to a sharp drop in price, as shown in the figure below.

The French public authorities have set a minimum landing price of 260 euros for a kg of restocking glass eels used in France, but the price for restocking in other European countries is much lower, averaging less than 150 euros.

This price makes it possible to release glass eels or farmed eels at a very low cost, the latter being sold at least 5 times the price of glass eels purchased from fishermen.

The socio-economic consequences for the French glass eel fishery are catastrophic.

In addition to the very low price of restocking glass eels, there is the obligation to allocate 60% of authorized catches to restocking (EU regulation 1100/2007).

For the 2024 – 2025 season, the restocking quota authorized by the French authorities was 38,160 kg, in order to comply with EU regulation 1100/2007.

For several years now, the quota allocated for restocking has been well above the demand (just over 28,000 kg for this season). This is largely due to the increasingly frequent use of young eels (whose price per kg is much higher than that of glass eels) produced by the farming sector from French glass-eels.

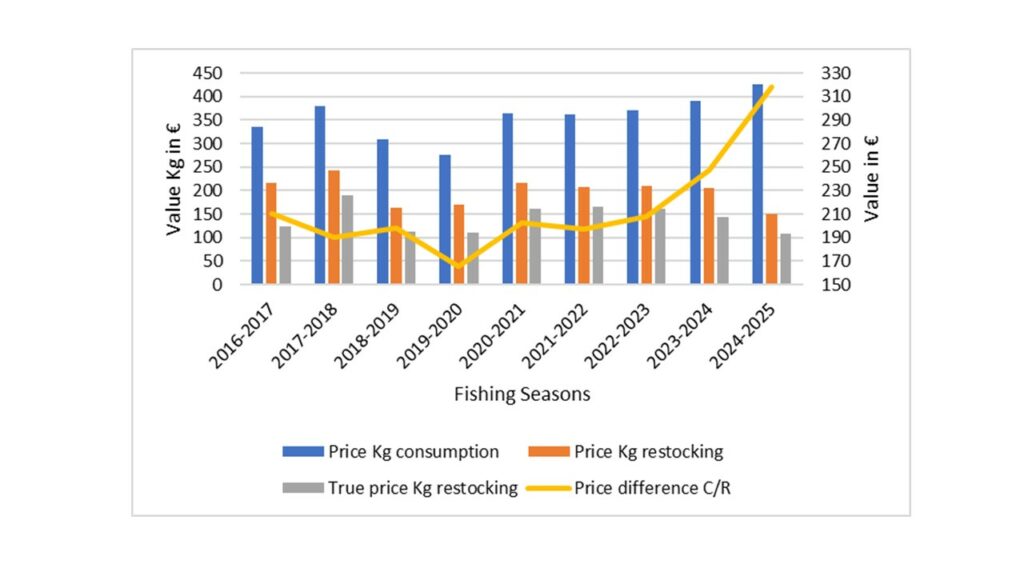

The consequences on the economy of fishing companies are therefore very serious, as shown in the graph below.

Over the last three fishing seasons, the difference between the average price actually obtained by fishing companies for glass eels on the consumption quota (100% of the quota consumed) and the price of glass eels for restocking has grown steadily (318 euros for this last season), largely due to the very low price of glass eels for restocking and the European Commission’s unjustified insistence on maintaining a 40% consumption and 60% restocking allocation key that is not adapted to the needs of the European glass eel market.

Thus, the value of catches authorized for restocking (60% of the total quota) represents only 28% of the total sales generated by this fishery, estimated at nearly 15 million euros.